Section 33 Income Tax Act

Income Tax 5 Section 23. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of.

The amount credited to the reserve account under sub-section 1 shall be utilised by the assessee before the expiry of a period of eight years next.

. Section 33AC 2 of Income Tax Act. Incometax incometaxlaws deduction section33 rebate incometaxact1961 taxation developmentrebate. I the cost of preparing the land.

Section 331 of the Income Tax Act 1967 ITA reads as follows. Section 33B of IT Act 1961-2020 provides for reserves for rehabilitation allowance. 1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which.

I First it sets out the Comptroller of Income Taxs CIT approach to the construction of the general anti-avoidance provision in section 33 of the Income Tax Act ITA. Held that the old section 33 was an annihilating section like section 260 of the Australia Income Tax. Sec 33 of Income Tax Act 1961.

And ii Second it. ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. The Income Tax Department NEVER asks for your PIN numbers.

A Digital eBook. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of. Chapter IV Sections 14 to 59 of the Income Tax Act 1961 deals with the provisions related to computation of total income.

Whats New Latest Cases. Section 33 Development rebate Income tax Act 1961. Section 33 in The Income- Tax Act 1995.

Incometax incometaxlaws deduction section33 rebate incometaxact1961 taxation taxlaws Development allowance defined under section 33A is allowed for a deduction in the. Ii the cost of seeds cutting and. The Andhra Pradesh Goods and Services Tax Act 2017.

1a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles. 1 Short title 2 Interpretation. Persons on whom tax is to be.

Income Tax Act 1947. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall. Income Tax Department Tax Laws Rules Acts Income-tax Act 1961.

Section 331 of the Income Tax Act 1967 ITA reads as follows. Personal Income Tax Act CHAPTER P8. Short title and commencement 2.

3 Appointment of Comptroller and other. Involving the old section CEC. Section 331 of the Income Tax Act 1967 ITA reads as follows.

Section 33 Income-tax Act 1961. Tax on income of individuals and Hindu undivided family. INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Section 33AB of IT Act 1961-2020 provides for tea development. Case Laws Acts Notifications Circulars Classification Forms Articles News D. Recently we have discussed in detail section 33AC reserves for shipping business of IT Act 1961.

Long Title Part 1 PRELIMINARY. For the purposes of this section actual cost of planting means the aggregate of. Table of Contents.

Comptroller of Income Taxn Winslow J. Com Law and Practice. Section 33A 7 of Income Tax Act.

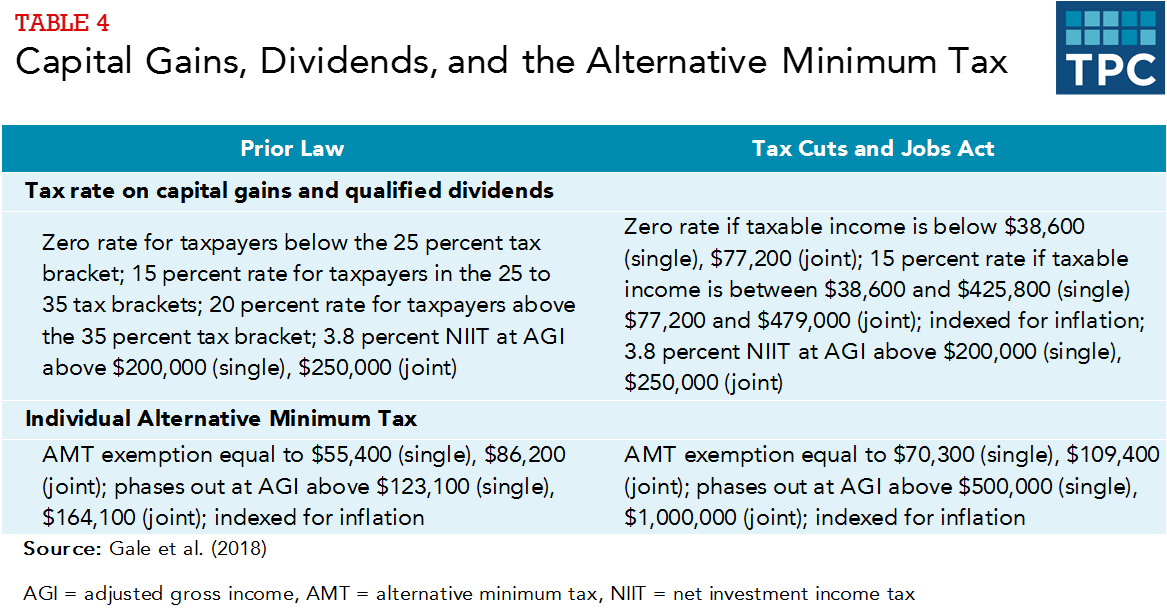

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

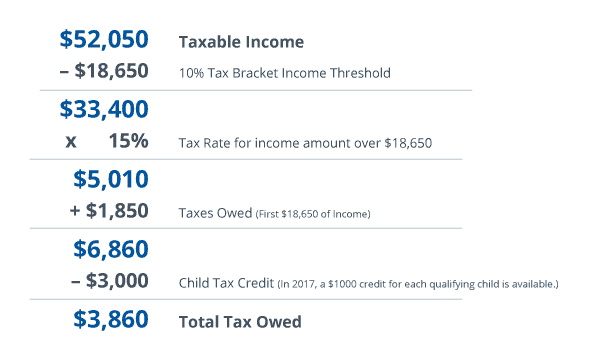

Standard Deduction Tax Exemption And Deduction Taxact Blog

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

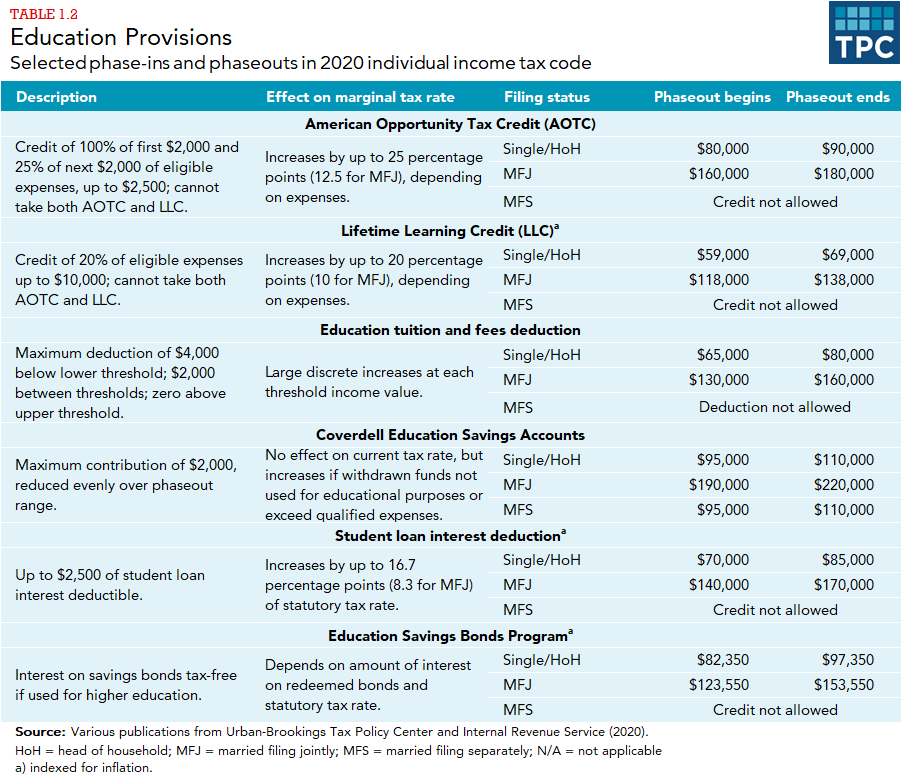

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Comments

Post a Comment